Belarusan Economy Digest: revolving around Russia

The chief economic events for October in Belarus include ratification of the EEU, continued fighting over re-export of banned European food to Russia, and an argument over Russia’s oil tax maneuver.

Russia’s actions, both political and economic, further complicate the situation with the Belarusan economy, which is exhibiting subpar growth for the third year in a row. Ironically, its troubled economy is forcing the Belarusan government to seek even more assistance from Russia.

Eurasian Economic Union and the oil tax maneuver

The complicated economic relationship with Russia was front and centre in news coverage during October.

As the Belarusan Parliament was contemplating the ratification of the Eurasian Economic Union (EEU) trade pact, Russia threatened the economic stability in Belarus with its oil tax maneuver. Under the terms of their bilateral agreement, Belarus has to pay an oil export tariff into the Russian state budget for an oil refinery product produced using Russian oil and that is destined for export.

Before signing the EEU agreement in May, Belarus negotiated a $1.5bn discount on its oil tariff payments for 2015. But afterwards Russia de facto annulled this preferential deal with its oil tax maneuver, a move, which partially replaces the oil export tariff with an oil extraction tax. Instead of saving $1.5bn in 2015, Belarus would have to pay basically the same amount back to Russia, effectively eliminating much of the income it hoped to bring in.

The disappointment surrounding the Russian ban on EU foodstuffs, which turned out to be not as profitable for Belarus as it had hoped (in particular, TIR business has suffered and the potential for re-exporting goods was significantly lower than expected), this tax maneuver has Belarusan society and the government questioning its choice of integration projects.

Just days before ratifying the trade pact, Russia made a promise to compensate Belarus for the oil tax maneuver, though how much it plans to offer has not been specified. Despite these issues, this conflict made one thing clear (and Lukashenka later spelled it out during a press-conference for the Russian regional media) - Belarus has zero interest in Eurasian integration unless Russia is going to pay for it.

Growth still slow as the Russian economy stagnates

In January-September 2014 the Belarusan GDP has grown only 1.5 per cent. The expected gains from the Russian EU food import ban did not materialise in August or September – the food processing industry is still stagnating, witnessing a 1.9 per cent decline in output.

But the other branches of the economy are experiencing decline as a result of the shaky economic situation in Russia. The production of goods traditionally exported to Russia – for example, machinery, transport vehicles or consumer goods like TV sets or refrigerators – has declined substantially.

Exports of these investment goods (machinery etc.) have also dropped due to the high level of economic uncertainty and a lack of financing in Russia, which is itself a result of declining levels of investment. An additional factor affecting the overall economic environment is the devaluation of the Russian ruble, which makes Belarusan goods relatively more expensive in Russia.

The exchange rate factor drives down consumer good exports as well. Moreover, it puts additional pressure on the Belarusan ruble, and the National Bank is already considering whether or not to increase the tempo at which the national currency is devaluated.

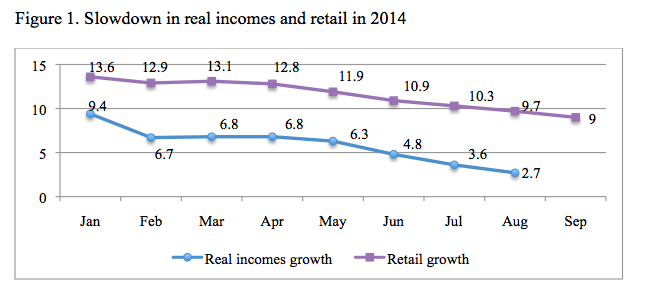

Trade, and, in particular, retail remains the main driver of growth in the economy. Retail is developing dynamically due to both the partial liberalisation of the sector and to a high level of income growth. However, as real incomes slow down, retail is slowing down as well. Over 2014 the real income growth declined from 9.4 per cent to 2.7. Retail is reacting with its own slowdown, declining from 13.6 to 9 per cent over 2014 (see Figure 1), and the expectations for the next year are similarly discouraging.

The worsening economic situation in Belarus, ironically, forces it to look for more financial support from Russia. Belarus still needs financing to repay its loans in 2014 and 2015.

Russia is currently facing financing constraints itself, given the sanctions its largest banks are dealing with. Nevertheless, it promises to help, but with strings attached, of course.

On 21 of September 2014 Russian Prime Minister Dmitry Medvedev during a visit to Minsk emphasised that Russian corporations are hoping to privatise several Belarusan state enterprises. The enterprises in question are, among others, the truck manufacturer MAZ, the electronics company Integral, military equipment procuders MKTZ and Peleng, and the nitrogen fertiliser manufacturer Grodno Azot.

While experts and international organisations, including the IMF and WB, have long advocated for the privatisation of these enterprises, the sale to Russian state corporations would only bring about modest increases in efficiency at best.

A Surge in bitumen exports

Bitumen sales schemes are starting to replace the old solvent sales schemes of 2012. Bitumen is a semi-solid that is extracted from heavy crude oil during the refining process and is more commonly known for being used in asphalt. In 2014 Belarus will still be required to make oil export tariff payments for exporting oil refinery products made from Russian oil. It turns out, however, that certain kinds of bitumen are not on the list of refinery goods.

In the first quarter of 2014 the exports of bitumen from Belarus increased by 182%. Moreover, according to official statistics the production of bitumen is two times lower than its export figures. From this, one may deduce that the exports of bitumen are disguising exports of other refined oil goods in an attempt to avoid paying export tariffs.

The scale of the operation so far has fallen short of the solvents smorgasbord of 2012. The Russian side has already expressed its concerns and initiated the creation of the working group to investigate the issue. Thanks to the oil tax maneuver, the bitumen scheme will become irrelevant in 2015, and Belarusan refineries will have to find other ways to survive.

The article was originally published at BelarusDigest

-

03.01

-

07.10

-

22.09

-

17.08

-

12.08

-

30.09