Belaruskalij: giving revenue, international prestige, balance of government’s books, and subsidizati

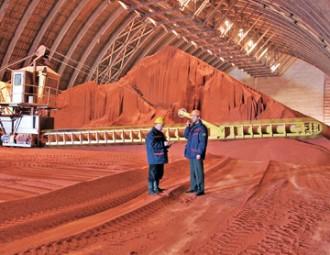

Without Belaruskalij, the world's second-largest producer of potash, many Belarusian companies would already have closed down, writes Ryhor Astapenia.

The company remains Belarus's only truly global business, and is a mainstay in the foreign business media. Its success also demonstrates that a state-run Belarusian enterprise can succeed even when in conflict with a Russian competitor.

Belaruskalij, the world's second-largest producer of potash, fared much better in 2015 than the Belarusian economy as a whole.

In spite of weak commodity markets, the state-owned company's annual export revenues are likely to be roughly the same as in 2014. Were it not for Belaruskalij, the recent slump in the Belarusian economy would be even worse.

Belaruskalij made headlines in July 2013 when it dissolved its joint venture with the Russian potash giant Uralkalij, heralding the end of the Belarus-Russia "potash cartel."

So far, the Belarusian authorities seem satisfied with the breakup. Belaruskalij has successfully rebuilt after the split and surprised its competitors by winning contracts through a combination of low prices, increased production, and successful marketing.

The most valuable enterprise in Belarus

Like oil refiners, Belaruskalij's fertiliser producers generate much-needed revenue for Belarus's small economy. But unlike the oil industry, the potash business became fully independent from Russia following Belaruskalij's split from Uralkalij two-and-a-half years ago.

Before the split, the Russian-led cartel took advantage of the heavily concentrated potash market (the only other major producers are Canada and China), forcing up prices by limiting supplies.

As a member of the cartel, Belaruskalij was bound by this "price-over-volume" cartel strategy. As a result, it failed to generate enough sales to plug deficits in the Belarusian state budget. Before long, Belaruskalij and Uralkalij started to cheat each other. The escalating conflict led to the arrest of Uralkalij's CEO Vladislav Baumgartner in Belarus, and eventually to the split between the cartel partners.

Contrary to expectations, Belaruskalij's revenue increased following the split. In 2014, exports of Belarusian potash fertilisers amounted to about $3 billion, or 6% of Belarus’s total export revenue.

In 2015, the amount may be slightly lower because of the decline in global potash prices, but still approximate $3 billion. Belaruskalij is also helping the government to balance its books -- according to the Ministry of Taxes and Duties, Belaruskalij paid almost half of the budget of Minsk region in 2015.

The success of the Belarusian potash giant enables Belarus to subsidise dozens of inefficient, loss-making "zombie" companies, such as Belarusian machine building enterprises.

In the first half of 2015, Belaruskalij was the country's most profitable company, earning eight times more revenue than Minsk Automobile Plant, the country's most indebted company. Without Belaruskalij, many Belarusian companies would already have closed down.

Moreover, Belaruskalij confers international prestige on Belarus. The company remains Belarus'sonly truly global business, and is a mainstay in the foreign business media. Its success also demonstrates that a state-run Belarusian enterprise can succeed even when in conflict with a Russian competitor.

What Belaruskalij accomplished in 2015

Belarus may not have made many new friends in the international arena over the past year, but it certainly has been a boon to farmers around the world, who are benefiting from low potash fertiliser prices. Belaruskalij's strategy of selling large volumes at low cost has helped it to increase market share and conquer new markets.

In March 2015, Belaruskalij made a deal with a consortium of Chinese buyers at $315 per ton, about $15-25 below the price offered by its competitors Uralkalij and Canpotex, the North American potash cartel.

On 8 December, Belarusian Potash Company, a trader of Belaruskalij, signed a memorandum of understanding to supply Vietnamese companies with fertilisers in 2016-2018. Belaruskalij has also made headway in South America, India and even the United States, where it faces protectionist policies.

At the beginning of 2015, Alena Kudravets, the director of the Belarusian Potash Company, stated that "every fifth tonne of potash fertilisers in the world comes from Belarus." She deserves credit for much of the success of the Belarusian potash giant. Belarusian President Alexander Lukashenka sang her praises in September 2015, calling her "a small girl from Salihorsk who saved everybody."

After the split of Belaruskalij and Uralkalij, Kudravets became chairwoman of the Belarusian Potash Company. Nobody expected a state-owned Belarusian company, where salaries are capped by the government, to retain top executives in competition with the private-owned Uralkalij. But as Aliaksandr Autushka-Sikorski, an analyst at the Belarusian Institute for Strategic Studies, told Belarus Digest, Belarusian Potash Company has defied the odds.

Will saving the economy threaten Belaruskalij?

Belaruskalij's "volume-over-price" strategy did much to keep the Belarusian economy afloat in 2014 and 2015. According to Autushka-Sikorski, the strategy made sense because it preserved market share by undercutting competitors.

However, the strategy of maximising output threatens the long-term existence of Salihorsk, the town where Belaruskalij is based. Salihorsk residents are afraid that at the current rate of production, potash deposits are being depleted, and in 15 to 20 years there will be nothing left.

A few years ago, one miner told me that “everything is great in Salihorsk, but what will we do when the salt runs out?" In 2011, Belaruskalij officials estimated Belarus's potash resources to last up to 40 years, according to Bielarusy i rynok (Belarusians and market). Yet at the current pace of production, the minerals may run out sooner. Indeed, the current strategy of favouring volume over price threatens Belaruskalij's own existence in the long term.

This year, Autushka-Sikorski says, the trends of 2015 are likely to continue, with supply outpacing demand. The price will drop further, forcing Belaruskalij to exhaust yet more of Belarus's precious resources in order to generate sufficient revenue for a teetering economy.

Originally published at BelarusDigest

-

03.01

-

07.10

-

22.09

-

17.08

-

12.08

-

30.09