Opinion: Extreme need of Belarusian state for foreign currency results in low prices for fertilizers

June 2016 became a breakthrough month for potash industry in Belarus: “Belaruskalij” managed to sign two contracts with two major potash consumers – India and Bangladesh, Aliaksandr Filipau informs.

However, the main news came from China: on June 17 Belarus received a $1,4bn loan from the China Development Bank for construction of a new mining and processing factory.

The parties reached this agreement after negotiations lasting more than one year. Although Belarus and China provided no information about a new potash contract, the very fact of this loan's existence provides grounds to suggest that such deal has been concluded.

A strange and long-awaited loan

Numerous news agencies have spoken about the deal between “Belarusbank” and China Development Bank. Unfortunately, all reports are relatively repetitive and provide very scarce information about the agreements.

According to press-releases, “the agreement, signed on Friday, stipulates the procedure for financing the project of building the mining and processing factory Slavkaliy, using raw materials of the Niežynskaje section of the Starobinskaje potash salt deposit in Minsk region of Belarus”. Neither report provided any further details.

Aliaksandr Lukashenka and Slavkaliy’s owner Mikhail Gutseriev announced an ambitious construction project at the Starobinskaje potash salt deposit. Later, different sources reported that Gutseriev does not intend to invest his own assets but rely only on allocated Chinese loans.

A representative of the “Belarusbank” described the negotiations as difficult. In, they started at least in May 2015 during Xi Jinping’s visit to Belarus. Chinese mass-media reported that in exchange for China’s loan, Belarus would supply four million tonnes of potash fertilisers for a total amount of $1,3bn, i.e. around $325 per tone.

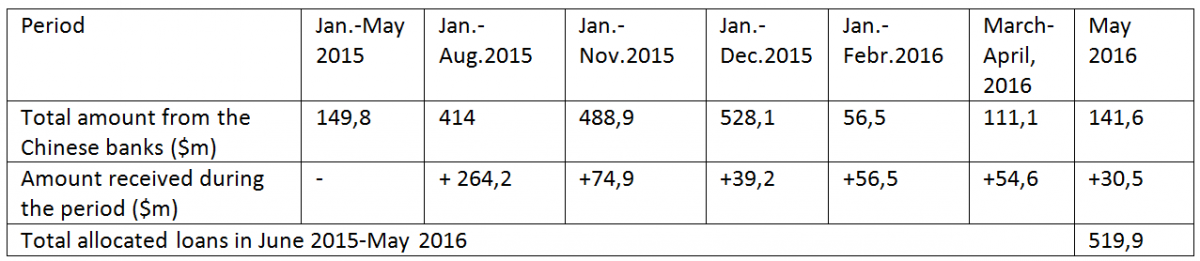

Data: the Ministry of Finances of Belarus

Nevertheless, since May 2015 no significant loans have come from China. The table below illustrates the amount of loans received by Belarus from Chinese banks in June 2015-May 2016.

The data demonstrate that in spite Xi Jinping’s visit and his intention to provide Belarus with Chinese, the final amount remained far less than Belarusian authorities’ stated expectations.

Asian patience

It seems that China did not hasten to conclude the loan agreement. Even Lukashenka’s visit to Beijing in September 2015 and his Directive No.5, which had introduced very favourable terms for Chinese companies working with Belarus, had limited influence.

Alongside continuing negotiations, China was actively purchasing potash fertilisers from Belarus. The country managed to accumulate huge stocks of these goods in order to guarantee a large price reduction in the future.

During the year 2015 Belarus significantly increased its exports of potash fertilisers to China (around two million tonnes in total), despite reducing prices. Such supplies helped China accumulate more than five million tonnes of stocks in potash fertilisers and prolong negotiations for a new contract with Belarus.

The year 2016 witnessed the first fruits of this policy. Belarus failed to maintain the same level of revenues from potash exports to China. In the context of the economic crisis this means less negotiating power for Belarus and its readiness to agree to less favourable terms. The break-off with “Uralkali” and the arrest of its manager Vladislav Baumgertner in 2013 also contributed to this situation.

India and Bangladesh

Belarus’ policy regarding potash markets in 2015 to a great extent resulted in a general potash prices reduction on the global market. Other main potash fertilisers consumers in Asia, primarily India, also tried to use the chance to obtain more favourable conditions, while the main suppliers tried to take a break in order to negotiate on higher prices.

However, because of the deepening economic crisis in Belarus and lack of foreign currency, the Belarusian authorities failed to secure much manoeuvering room. On 24 June Belarus signed a contract with Bangladesh, although the exact price remains unfamiliar to the public.

On 27 June Belarus agreed to sell 700,000 tonnes of potash to the company Indian Potash Limited at $227 per tonne, the lowest price in a decade. Usually, the first contract is signed by the major producer, while the others use the agreed terms as a benchmark for their contracts. This year “Belaruskalij” has broken with this tradition.

The competitors believe that this price is unacceptably low, while the consumers expect even more favourable conditions. However, the main question concerns which decision China will take. Will the Chinese authorities follow the Indian example or are they sure that they are able to guarantee a lower price?

Have the parties already made the deal?

No one can expect a loan from China without a clear profit for officials in Beijing, particularly in the sphere of potash fertilisers. More than a year of negotiations, as well as China’s elaborated policy on the global potash market should bring positive results. The loan agreement signed on 17 June definitely contains important details which have not been revealed to the public. They remain a matter of speculation; however, a few details provide fertile ground for consideration.

First of all, the borrower is “Belarusbank”, while the finances will go to the “Slavkali”, a company owned by Russian businessman Mikhail Gutseriev. The direct interests of Belarus remain unclear.

The second point concerns the reasons, which pushed China to allocate this loan. Does it mean that Belarus agreed to supply potash fertilisers for less than $200 and for a long period of time? Unfortunately, the potash sphere remains one of the less transparent businesses in Belarus. The lack of transparency results in serious failures on the global market, including the Chinese one.

Conclusions

Belarus and China prevent distribution of reliable information about their cooperation in the field of potash fertilisers. Due to conflicting interests, the negotiations between the parties lasted more than one year.

However, the fact that the loan was agreed upon on 17 June proves that the parties managed to conclude an agreement. The successive contracts with India and Bangladesh support this theory.

Low prices in the contract with India, desperate need of the Belarusian authorities in foreign currency and China's preparedness for lengthy negotiations suggest very low prices for Belarus fertilisers on the Chinese market.

Originally published at BelarusDigest

-

03.01

-

07.10

-

22.09

-

17.08

-

12.08

-

30.09