Eurasian Studies: International Lenders of Last Resort uphold current systems' status quo in Belarus

Moving away from market-based, profit-seeking practices will continue as long as there are viable mechanisms to keep the current systems afloat.

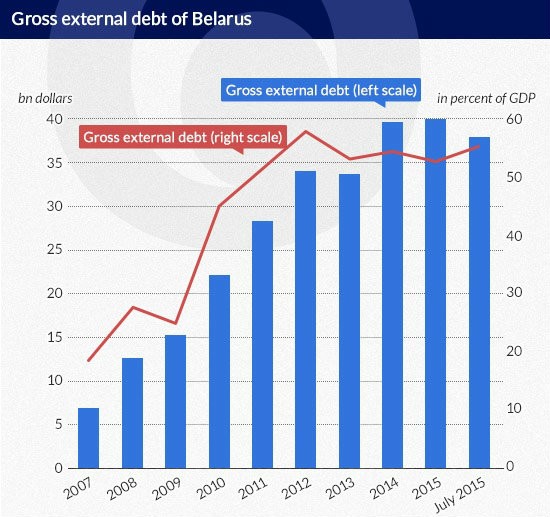

"Post 2015 election result, as per the IMF forecast, Belarus’ GDP is expected to decline by 2.2% in 2016. The forecast for 2015 has been revised downwards – GDP is expected to shrink by 3.6% instead of 2.2% according to April forecast. The deterioration is due to the slower pace of economic recovery in the developing countries with a view to preserving the current level of oil prices. In the near future investment in fixed assets will curb, household incomes will continue to fall, competition for jobs will increase, and inflation somewhat decline due to lower consumer demand. The current account deficit of 4.3% of GDP requires a search for external funding sources to service the public debt, since Belarus does not have sufficient domestic resources to service her debt." - Belarus in Focus

Belarus initially weathered the global financial crisis better than its neighbors and trading partners. The state's grip on industry and the strongly centralized powers allowed the administration to directly steer the country away from the crisis as it swept through Europe, the United States, and Russia. State ownership of many industries allowed the leadership in Minsk to control the behavior of large economic actors aimed to increase domestic demand in the face of decreasing exports (Kruk, 2013). The tactics worked initially and superficially. Belarus was one of only two Eastern European countries to see a positive albeit small growth in Gross Domestic Product (GDP) in 2009 and it was able to keep its currency peg of 3000 Belarusian rubles to the U.S. dollar. The following year, its GDP increased by 7.7 percent, despite its exports to the Euro Zone dropping by almost 45 percent in 2009 and largely stagnating in 2010 (European Commission, 2013).

Image Attribute: www.financialobserver.eu

Eventually, stimulating domestic demand was not enough to offset the dip in trade by its main trading partners Russia, Ukraine, and the European Union (primarily Germany and the Netherlands) (United Nations Statistics Division, 2013), many of which depreciated their currency to stay competitive. By June of 2009, the countries at the heart of the financial crisis began to migrate towards the perceived security of the U.S. dollar. The Russian Ruble began to depreciate against the dollar, as did the Ukrainian Hryvnia. The Euro followed suit at the end of the year. Belarus initially tried to hold fast to its currency peg. Exports suffered as the real price for Belarus's goods increased with respect to its trading partners. Its foreign currency reserves dwindled as it became less globally competitive. Increasingly, Belarus was unable to make up for dips in export.

By 2011, Belarus's ability to command its way out of the financial crisis was dwindling. It was facing a balance-of-payment crisis, with shrinking foreign currency and gold reserves. It depreciated its currency and by end of year, the ruble had dropped to almost a third of its value with 8500 Belarusian rubles to the dollar. Consumer prices grew by 107 percent (Bornukova, 2012), driven mainly by a sudden increase in the prices of imported goods.

Image Attribute: Welcome To Hyperinflation Hell: Following Currency Devaluation, Belarus Economy Implodes, Sets Blueprint For Developed World Future by Tyler Durden on 05/25/2011 / Source:Zerohedge.com

The price fluctuations more greatly affected the higher income earners purchasing imported goods, as many essential domestically-produced goods and services were subject to price controls. While the prices of many goods increased, long-standing price controls meant that much of the population was somewhat shielded from the entire effect of the rise in inflation. Domestically-produced items not subject to price controls, for example meat and poultry, saw a rise in price almost in percentage parity to the exchange rate depreciation (Bornukova, 2012).

More harmful to the average population, and especially to pensioners, was the drop in real income and the depreciation of their Belarusian ruble-based savings. The average real income of a Belarusian decreased by fifteen percent in 2011 compared to the year before. Pensioners saw their stipends fall in real terms by 29 percent. The percentage of the population that fell below the poverty line more than doubled from the beginning to the end of 2011 (Bornukova, 2012). It could have been argued that the fall in real income for pensioners would be the greatest threat to the Belarusian system. It is the pensioners who by majority believe that the demise of the Soviet Union was a mistake and support the resistance to westernize (White, 2010). It follows that a failure in the current system could have hurt that support. Lukashenko attempted to placate the pensioner population by increasing pensions ahead of the 2010 presidential election, furthering the financial crisis but maintaining support for the current system.

The Only Available Way-Out – The International Lenders of Last Resort:

Belarus's journey into, and initial response to, the financial crisis was markedly different from its neighbors, but its overall attempts to repair its economy is an area where it converges with its western counterparts. The path Belarus took in seeking a way out of the financial crisis puts it in demonstrated contradiction to the Marxist literature advising on paths out of the financial crisis. Belarus paid lip service to Lenders of Last Resort (LOLRs), agreeing to concessions that would take the economy on a more wholly market-based path. The international LOLRs made conditions for the loans, bringing Belarus more greatly in line with the western policies that Marxist literature blamed for the crisis.

Image Attribute: The Plaque of IMF Office in Minsk, Belarus

Prior to its 2011 crisis, Belarus sought and accepted a 2.5 billion dollar loan from the International Monetary Fund (IMF) in 2009 to bolster their gold and foreign currency reserves and to support the fixed exchange rate. In return, Belarus agreed to undergo a fifteen-month economic reform program. As Belarus began to feel the full effects of the financial crisis in 2011, the IMF later increased the loan amount to 3.5 billion, and Belarus agreed to implement structural reforms aimed at improving macroeconomic policy in the real economy. Belarus later accepted a 3 billion dollar loan from the Russian-led Eurasian Economic Community's Anti-crisis Fund. The Community's loan came with conditions, including the sale of 7.5 billion dollars in state-owned assets (many of which Russia had interest in purchasing) and increased bank lending to the economy (“Belarus Ratifies Treaty,” 2009).

The LOLR solidified its role as a crucial lifeboat for many countries during times of financial crises during the late nineteenth and early twentieth century, when many countries experienced runs on banks simultaneously with currency crises (Goodhart & Illing, 2002). Originally, it was a country's central bank that played the role of LOLR to cushion liquidity shocks. As globalization connected economies, financial crises were increasingly an international problem for stats rather than a domestic issue. Capital flows began regularly crossing borders, and thus, a financial crisis in one country could affect the situation in another. The risks associated with such interconnectivity were identified as the “international financial contagion risks” and the response to these risks was to internationalize the role of LOLR (Huang & Goodhart, 2000).

In the 1990s, the literature began to examine the increasing role of an international LOLR, that is, it began to ask about the appropriateness of a multinational organization or institution acting as LOLR to an entire country's banking system. This debate was framed by an acceptance in the 1990s of the greater efficiency on the macro level appreciated by countries that were open to international capital flows (China and India's growing economies during this period aside) (Fischer, 2002). To accept the principle that international capital flows increased overall wellbeing, it was also necessary to accept that financial crises must be kept at a minimum, thus bringing to the forefront the crucial role of the international LOLR.

The IMF, has become principal international LOLR, although its founders deliberately wrote its Articles of Agreement to avoid the IMF taking on this role. However, Boughton and Lombardi (2009) and Calomiris (1998) argue that the IMF has been going in the direction of becoming principal international LOLR since the end of Bretton Woods in the 1970s. Russia led the way towards a Eurasian international LOLR when it created the Anti-crisis Fund for the Eurasian Economic Community (EEC) in 2009. Its primary goal is to assist EEC members (Russia, Belarus, Kazakhstan, Kyrgyz Republic, and Tajikistan) hardest hit by the financial crisis (EurAsEc Anti-Crisis Fund, 2013). As with the IMF, the monies in the EEC's Anti-crisis fund are available with conditions for its recipients.

Intervention by a LOLR invites criticism; it’s very existence possibly contributing to a suspension of market discipline by taking away the risk of failure. This stands in contrast to the original Bangehot LOLR principle to “lend freely, at a high rate, against good collateral,” Any LOLR must have “technical autonomy and effective sanctioning power” (Giannini, 1999, 2). Giannini (1999, 1) argued that the only way to minimize the moral hazard associated with an LOLR was to rely on the “broader legal and institutional setupdon regulation in the broadest sense of the word.” However, in light of international organizations legitimacy coming from a critical mass of members and the buy-in of those, international LOLRs depend on the cooperation of state-level leaders to maintain its ability to lend funds with conditions attached. Often international LOLRs make loans without such collateral prerequisites as their state-level counterparts, but instead make conditions for the loans that countries adhere to when accepting the bailout funds.

When Belarus accepted IMF assistance, it also accepted IMF's conditions for greater privatization, its critiques, and its guidance. The IMF's goal for Belarus includes tightening of monetary, budget, and tax policies. Belarus furthermore agreed to reforms in its exchange rate policy (Lis & Koliadina, 2012). Belarus's acceptance of assistance from the EEC Anti-crisis Fund meant it agreed to sell some of its state-owned industries to Russia and further privatize other industries, as well as agreeing to reform monetary, budget and tax policies, with some emphasis on easing tariffs between Belarus and other EEC members.

That a post-Soviet state would promise reform when offered a lifeline by a LOLR is not a new concept. PopEleches (2008) argued that regardless of a state's ideological differences with market capitalism, in Eastern Europe, states that were experiencing hard currency crises were more likely to seek and accept assistance from the IMF during the 1990s. His analysis found that Eastern European states with reformist-minded governments were statically equally as likely as states whose governments resisted reforms to make necessary concessions needed to enter IMF programs. In Belarus, in 2010, the prospect of an upcoming election paired with a hard currency shortage saw the government ready to set aside their partisan differences with the IMF and agree to implement the requisite privatization programs for IMF assistance. In fact, it had begun to look to privatization to solve its hard currency problem before seeking IMF assistance as a way out of its financial crisis. In times of strong inflation (over 140 percent), former communist states in Eastern Europe are far more likely to initiate IMF-style reforms.

Although some Marxist literature heralded the remarks by Buiter (2008) that private finance, with its risks and bubbles, should give way to the public sector to regulate and control, Belarus, already with a strong grip on its financial system, was promising to open itself up to the global financial system and decrease its strong tradition of state ownership. It promised to deviate from its own mechanism of production, ownership, and lending (championed by Davies (2011) as a way out of the crisis) and go towards the uncertainties of the global financial market that Davies (2011) said was the wrong path from the crisis.

It should not be argued, however, that Belarus sprung into reform upon agreement to the terms of the international LOLRs (IMF, 2013). In a 2012 report, the IMF noted that Belarus has made little progress in its market reforms and has reversed some of the price liberalizations put into place in 2009-2010. The IMF criticized Belarus for continuing to focus on output (rather than profit), at the expense of efficiency, as well as its distortions of market indicators as a result of government-controlled investment, the dominance of state-run banks, and an inflexible labor market (Lis & Koliadina, 2012). In addition, Belarus's last tranche of the EECs Anti-crisis Fund was delayed in late 2013, as it had not yet met the reforms and privatizations necessary for continued support of the EEC (“Decision on Sixth Tranche,” 2013). Furthermore, while a country can attempt to control its banking sectors, it has a more difficult time controlling its population's trust, and many of Belarus' citizens prefer foreign currency. Although Belarus agreed to market-focused reform, its lag in their implementation has been cause for further issues (rather than their salvation), including slow growth, trade imbalances, and pressure on banks that are experiencing shortages in ruble funding (IMF, 2014).

The connection to the Marxist literature can be seen in the steadfast nature of the international LOLR. Ultimately, the international LOLRs, although dependent on quotas given by the very countries hit hardest by the financial crisis, did not buckle or weaken in the face of global financial crisis. Marxism's appeal never made it past the literature and occasional public demonstrations to applied policy because there has, heretofore, been no need for such grand structural and institutional reform anywhere in the western world. When Belarus faced its own financial crisis, it first turned wholly towards LOLRs and promised reforms that would increase its dependence on the global market. When it largely ignored its promises, its problems persisted. In the current interdependent world, the literature on Marx's solutions no longer provides answers, or even viable suggestions.

Conclusion:

When Belarus's leadership notoriously skeptical of Western reforms and outside intervention by even its allies are willing to promise market-based reforms in times of financial crisis to qualify for much-needed liquidity, it should be little wonder that the Marxist advice espoused in the thick of the financial crisis has been largely ignored by policymakers. When Belarus ignored its promises and sunk further from recovery, it lends credence that reform away from market-based capitalism is not effective in the globalized economy. By examining the case of Belarus, it is possible to see how international LOLRs not only maintain current systems' status quo, but can also compel a state to desire greater integration to the global market. Belarus' continued struggles as a result of ignoring the reforms show further that closing oneself off from the global market and attempting does not provide relief. The existing Marxist-leaning literature, by ignoring the situation in Belarus, fails to see the game-changing impact that, among other factors, strong LOLRs have in maintaining current market-based practices. Predictions of protests-cum-reform, a change to the global order, and a movement away from market-based, profit-seeking practices will continue to come up short as long as there are viable mechanisms including international LOLRs to keep the current systems afloat.

Published at IndraStra Global

-

03.01

-

07.10

-

22.09

-

17.08

-

12.08

-

30.09