BelarusDigest: Will Belarus Lose The Chinese Market In 2016?

On June, 9 the Council of Ministers of the Republic of Belarus appointed high-ranking officials personally responsible for implementing a number of investment projects.

Prime Minister Andrej Kabiakou became supervisor of the BelGee project (vehicles production).

This move emphasises the importance which the Belarusian authorities attach to relations with China, even in spite of permanent criticism of their policies in this regard from independent experts.

The Belarusian government has declared three pillars in this cooperation: mutual support in the international arena, loans and investments from China and growth of Belarusian exports to the Chinese market.

However, exports have always been a weak point in Belarusian foreign policy, particularly in relations with China. In spite of numerous optimistic promises, for many years China has remained the most unfavourable trading partner of Belarus.

Although the years 2014 and 2015 witnessed some seemingly positive changes in this situation, Belarusian exports to China are becoming increasingly counter to the national interest.

Belarus-China trade in 2011-2014: optimistic promises and disappointing results

Belarus-China trade has always been a matter of serious discussion in Belarusian expert circles, due to the fact that it clearly goes against Belarus' declared export-oriented foreign policy. One can hardly expect a positive trade balance between any country (excluding oil and gas exporters) and China.

However, in the case of Belarus the imbalance between Belarusian exports to China and Chinese imports to Belarus has been particularly acute. The clear discrepancy between the officially proclaimed goals of Belarusian foreign policy in general – export growth – and the trade deficit with China has always been a source of tension in the development of Belarus-China relations.

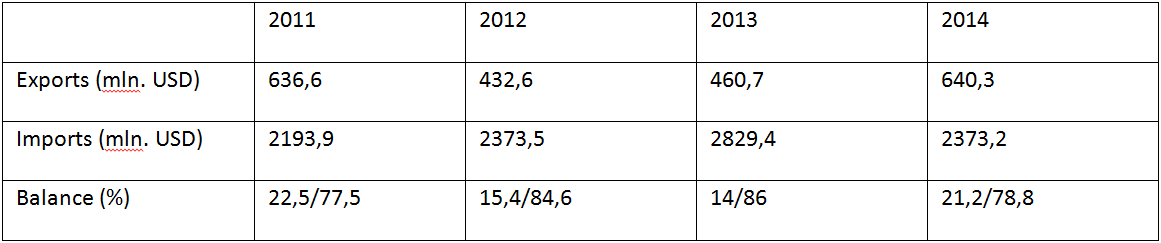

The table below illustrates the export-import balance in Belarus-China trade in 2011-2014:

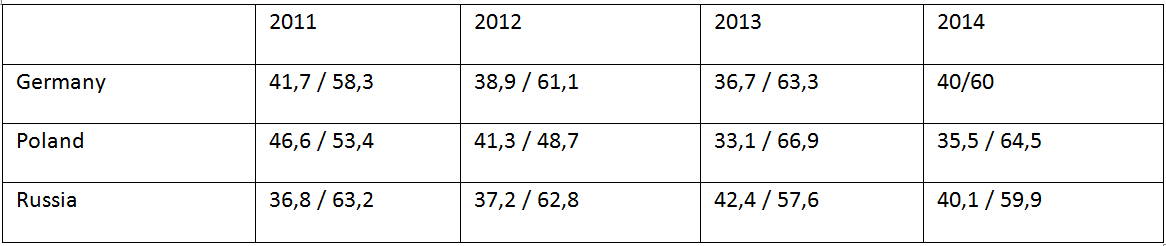

Such an imbalance can hardly be compared to that with Belarus’ other key trade partners – Poland, Germany and Russia. All are countries with both significant exports and imports, as well as a significant variety of traded commodities:

Moving towards improvement in 2015?

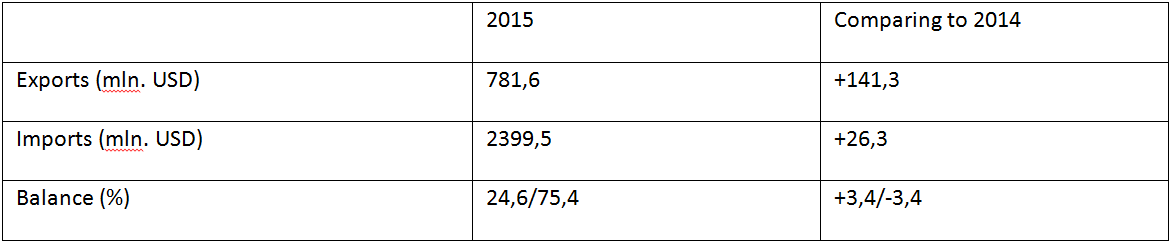

However, the year 2015 witnessed more positive changes in bilateral trade, a trend which started in the year 2013. The table below illustrates these changes:

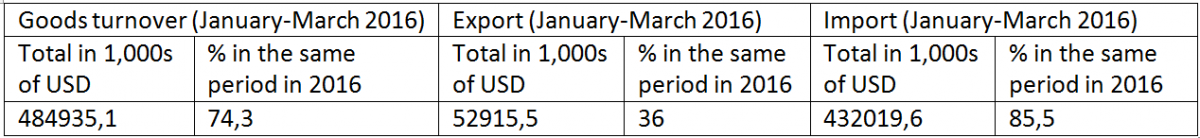

In spite of the low growth in Chinese imports, Belarusian exports to China demonstrated significant growth. A number of Belarusian and Chinese officials pointed to these figures as a successful achievement in bilateral relations and even as a qualitatively new trend in mutual trade. Unfortunately, this trend was not sustained in January-March 2016. The table below illustrates this:

No new trend, the same decline

The dramatic fall in Belarusian exports to China combined with the comparative slow down in Chinese imports to Belarus are grounds to examine more carefully the reasons for the positive trends in 2015.

Potash fertilisers contributed $650m, or 83.16 per cent, of Belarus’ exports to China in 2015. In 2014 the share of potash fertilisers totaled 71.1 per cent of Belarusian exports to China. This means that de facto Belarus reduced its exports in China.

This reduction corresponds with the general trend in Belarusian foreign trade since 2012 and, as some experts believe, illustrates the processes of de-industrialisation in Belarus and the decline of its economy. The emergence of competitors in the potash fertiliser market and the decrease in the value and amount of other commodities mark the first main trend in the Belarusian export to China.

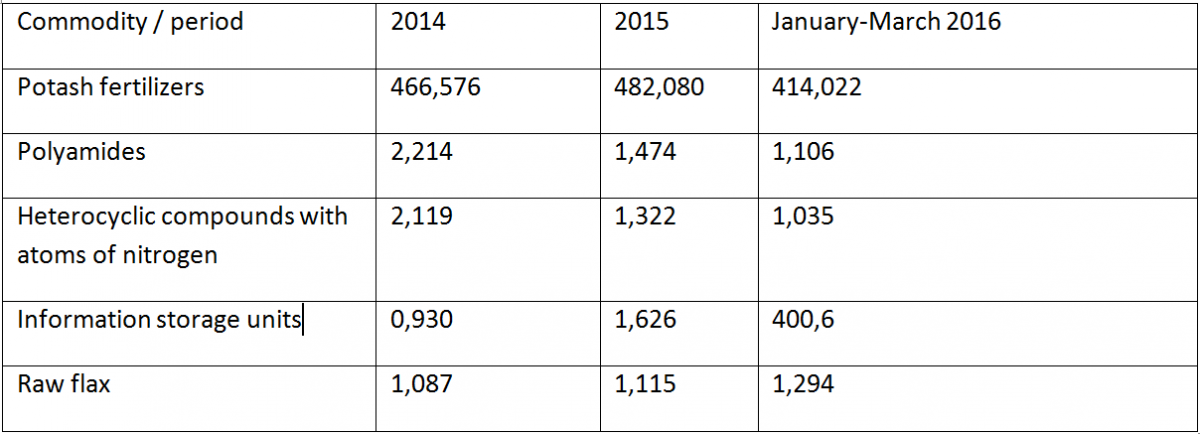

The decrease in prices for Belarusian exports to China marks the second basic trend in bilateral trade. The table below illustrates this trend via the medium price (in USD K.) for the five most significant groups of commodities:

Unfortunately, Belarusian statistics do not include the prices for potash fertilisers exported to China. The figures in the table reflect the export prices for Belarusian potash fertilisers sold beyond the CISmembers. Usually, Belarus sells these fertilisers to China at even lower prices.

For example, Bloomberg reported that in 2015 Belarus sold potash to China for $315 per metric tonne, including shipping costs. Competitors considered this price to be unsustainably low. No clear information is available on the prices in 2016. However, according to data from VTB bank, market prices may go below the psychologically important level of $200.

Two other main commodities – polyamides and heterocyclic compounds with nitrogen atoms – have also seen a decrease in their export price to China. Polyamides experienced the lowest price level compared with export prices to other countries.

Is China playing on this scenario?

The tables above illustrate that the Belarusian authorities, who desperately need foreign currency, have concentrated their efforts on increasing the volumes of exported potash fertilisers on account of prices cuts. Such a policy will lead to positive results only in the short-term, while in the medium- and long-term it can have only negative outcomes.

Sad to say, Chinese policy-makers are well aware of this and have an elaborate strategy to protect their economic interests on the potash market. Bloomberg’s and VTB’s experts report that

China is sitting on above-normal inventories of up to 5 million tonnes, domestic production is running at full speed and railway deliveries from Russia as large as 120,000 tonnes per month continue, so the country is not in a rush.

Some of this 5 million tonne stock certainly came from Belarus in 2015.

It is not the first time that the Chinese have adopted this strategy of buying low-priced potash fertilisers, accumulating large stocks and promoting further competition between suppliers to keep prices low. In particular, the same scenario occurred in 2013.

However, the Belarusian authorities do not have many choices: the country needs currency now, and it seems that nobody is thinking even in a medium-term perspective. The logical results of this policy already came to bear in the first half of 2016 when Belarus failed to make significant exports to China, including of potash fertilisers, and now risks facing a dramatically low price of $200 per metric tonne.

Shaping results for the year 2016

There is no doubt that any exporter to China faces great challenges in this market. However, the analysis of Belarusian exports to China since 2013 reveals a substantial narrowing in the range of exported commodities, lowering of medium prices and a growing share of potash fertilisers in the overall export market. This policy brought moderately positive results in 2013-2015, promoting slow growth of exports and reducing the imbalances between exports and imports.

Unfortunately for Belarus, trade results for January-March 2016 demonstrate that such a policy has exhausted its capacities.

The year 2016 is going to be a catastrophe for Belarusian exports to China due to low prices for potash fertilisers and the total absence of any opportunity to compensate these prices by increasing volume of supplies, as well as the lack of capacity to propose other goods to the Chinese market.

It seems Belarus is going to see significant currency losses in its trade with China this year in the context of a deepening economic crisis in the country.

Originally published at BelarusDigest

-

03.01

-

07.10

-

22.09

-

17.08

-

12.08

-

30.09